Mobile Loan Origination System for the Growing NBFC's

Mobile Loan Originating system enabling collaboration within the team, helping Reps to connect efficiently with customers and partners. Drive better decisions by exploring your data.

LEAD LIFECYCLE

Lead allocation

Right lead for right reps via intelligent allocation

Forms & Stages

Customised forms with stage restrictions

Documents

A centralised database for customer docs

COLLABORATION

Deviations

Rule based auto deviations with SLAs

Recommendations

Get actionable nuggets instantly

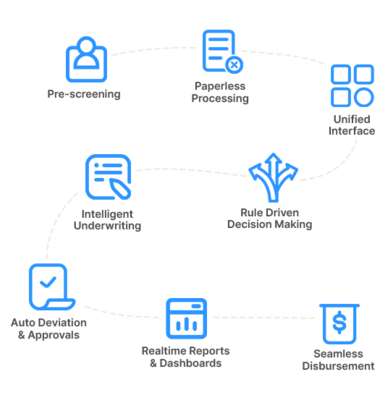

Digitize and Improve the Lending Process at Every Step

Implement fully Automated Workflow Flexibility in Regulatory changes with help from experts

Reduce TAT

Make all your processes, Approvals & Verification in reduced turnaround time.

CIBIL Reports

Generate CIBIL Via mobile to get insights into the lead’s credit history on the move.

Auto Underwriting

Business rule engine to bring a dynamic shift in the way loan approvals happen.

Auto Deviations

Remove complex dependencies through automated business logic engines.

Multi-stage Approval

Get actionable notifications & approvals in real-time during the disbursement process.

EKYC

Integrated end-to-end with Karza E-Bill to manage all the KYC verification in real-time.

Collection & Recovery

Collections with payment gateway, tracking and LMS integration capabilities.

DSA Management

Faster onboarding of DSAs & visits to minimize potential supply-side risks and delays.

Campaigns

A suite of products to help sales leaders influence sales teams’ performance & motivate sales

Reduce Cost

Significantly reduce operation costs by adopting digital transformation.

MIS Reports

Faster business decisions with custom MIS reports in real-time to upgrade the experience.

Business Intelligence

Insights to take a practical data-driven approach for taking any decisions for scalability.

BEFORE TOOLYT

AFTER TOOLYT

25x

Cost Saving from the Entire Process

75%

Increase in Lead Conversion Rates

70%

Reduction in Process Turn Around Time

2/3

Time Saved in Sales Cycle

99%

User Adoption in the Application

CASE STUDY

"How we helped one of the India's largest NBFC achieve an 86.1% increment in loan disbursements"

There’s a New Way to Grow your Sales

Toolyt can help you change how you onboard the customers and do the loan disbursement process with the most integrated and mobile first application.

With the help of Toolyt, all the complexities of sales will turn into rapid growth :

Sales Team

Identification of potential leads with real-time CIBIL report verification/lead scoring.

Credit Team

Implementing stage restriction before moving on to the next stage for complete data-collection.

Decision Makers

Eliminated manual entries and ensured record keeping via real-time visibility of MIS reports.

Integrations that Automates your Business Process